Receipt templates

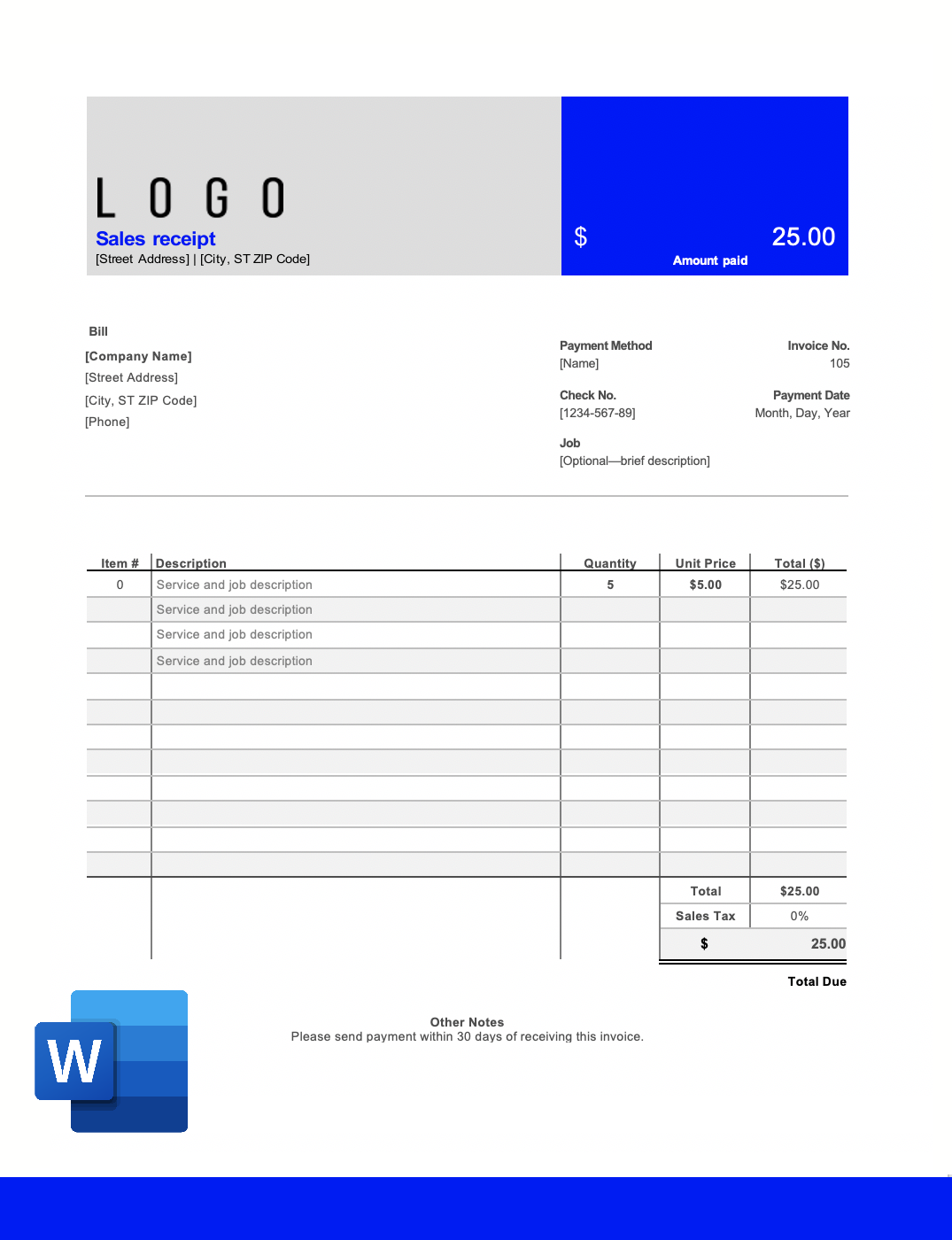

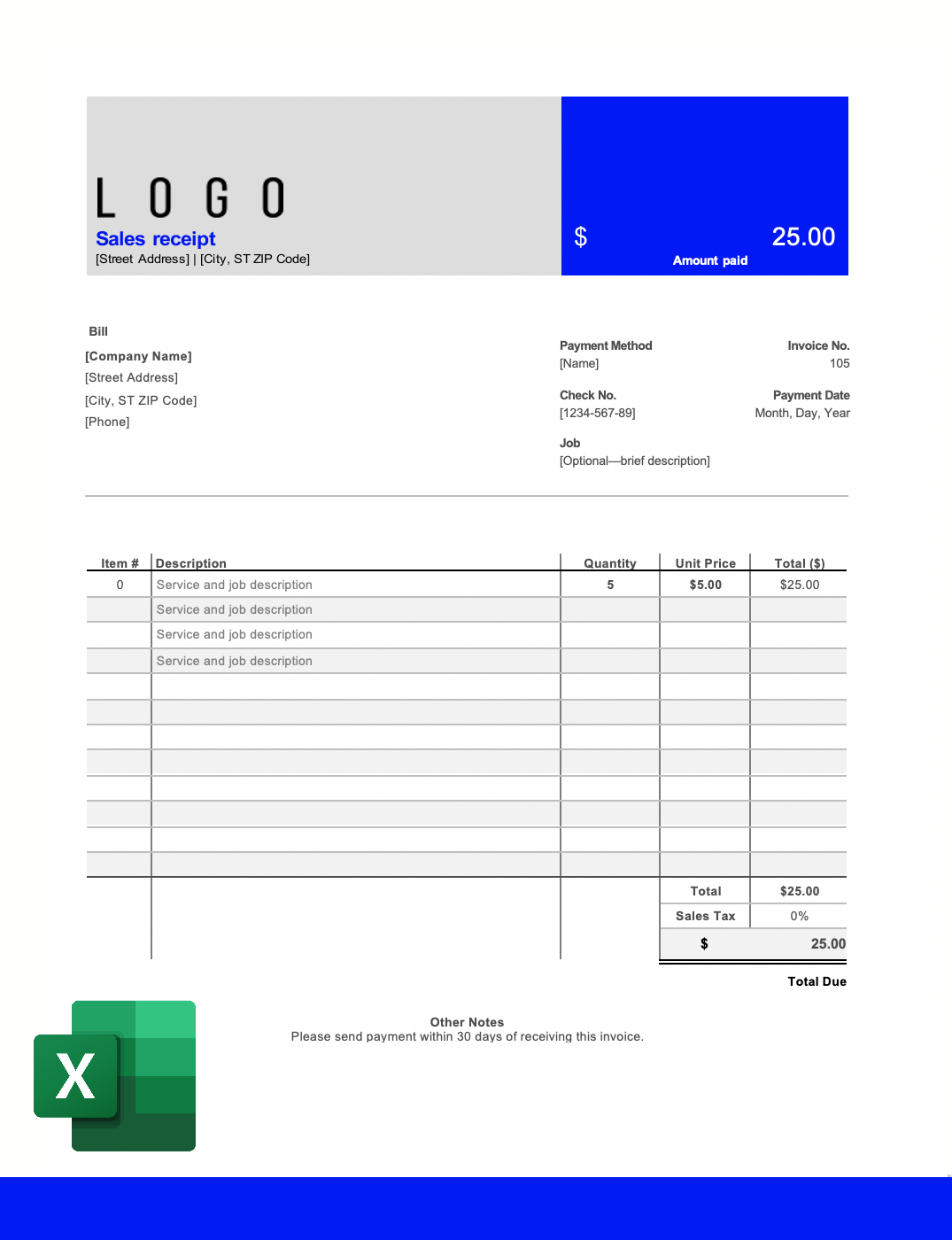

Download our free invoice receipt template for Word or Excel.

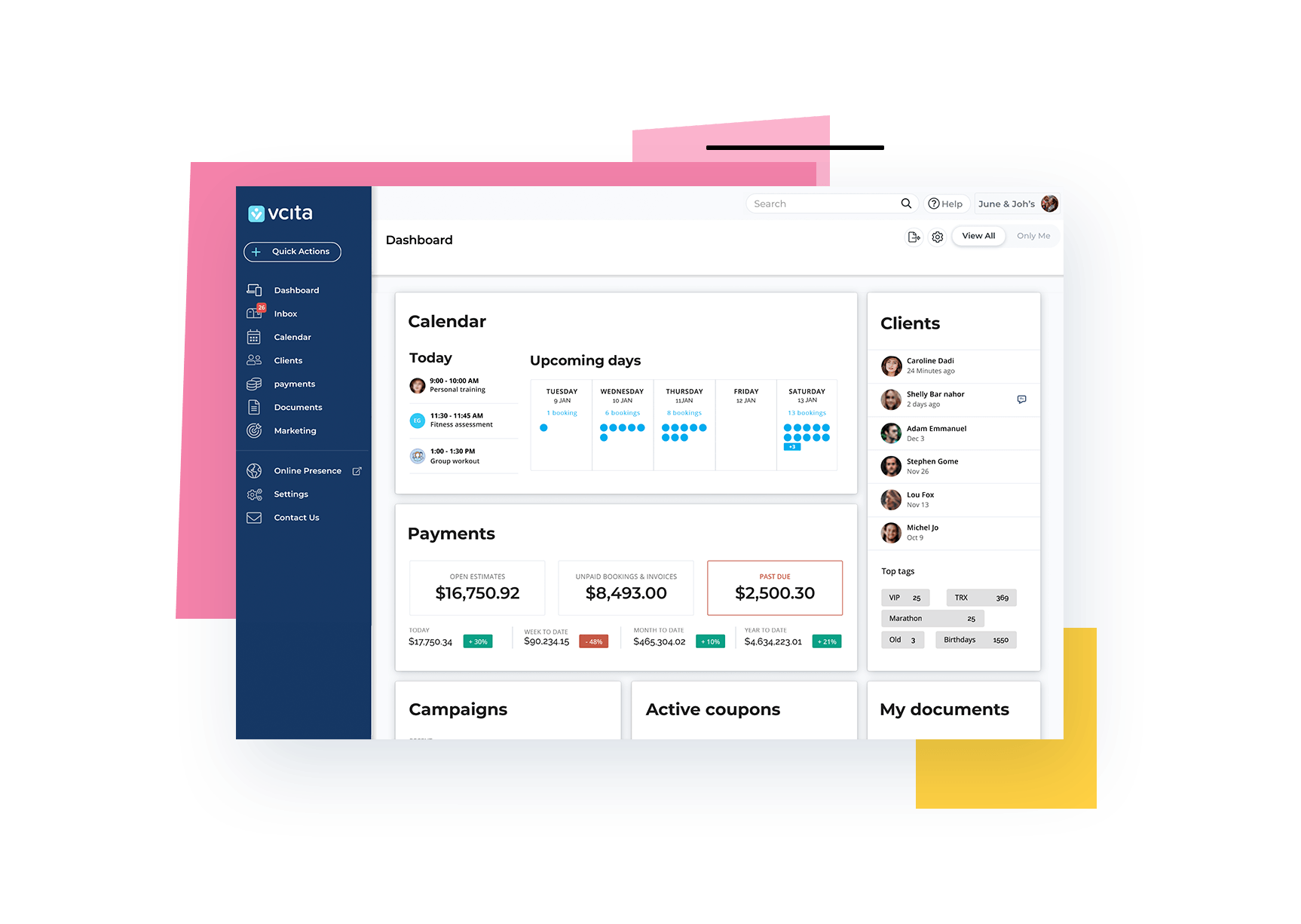

Or…start to create and send unlimited receipts with vcita.

Try 14 days for free.

Download our free invoice receipt template for Word or Excel.

Or…start to create and send unlimited receipts with vcita.

Try 14 days for free.

If you don’t love accounting, you might not feel excited about dealing with invoices and receipts.

What a lot of small business owners don’t realize is that they aren’t just a necessary part of creating a professional, trustworthy payment experience for your clients – confirming that you received your clients payment, they’re also part of your branding, and their look and feel with reflect back on you.

Make sure your clients always receive an automated payment confirmation email or SMS, when you have received a payment.

Say goodbye to messy billing, and hello to vcita invoice and payment processing app that does all your billing processes for you.

Select File>Choose new and search for “receipts” in the Office.com templates search box to bring up its selection of free receipt templates. It’s advisable to spend time customize the template you’re using, since Word templates can look quite generic to clients that also use the Microsoft Office suite.

If you don’t feel like bothering with modifying one of the Word’s generic templates, download vcita’s ready-to-use elegant, free receipt template.

You can easily add your logo, fonts, and other branded elements like headers and footers, and save it as a template in Word so you can access it later.

With Excel, you can create additional worksheets by clicking on the “+” icon beside “Sheet 1,” which is helpful if you need multiple receipt templates for one client—for example, one official receipt and one packing slip.

You can also use the sum function to add the totals from receipts on different worksheets, which is a helpful way of tracking AR if you don’t have automated billing software.

You can also use free templates or create custom templates in Excel, but for an easier solution, download vcita’s professionally designed, and pre-formatted Excel receipt template. As with Word, you can save it to Excel’s template files to access it later whenever you open a new document.

A key element of brand identity is consistency. Having a streamlined payment flow from sending an invoice to confirming payments and sending sales receipts will help you reinforce your brand and establish your professionalism. Using a branded receipt template format means you’re less likely to forget important elements, like invoice number and contact information.

Additionally, you will have all payment records collected one place, it’s helpful for both you and your client to know at a glance where totals, subtotals, and receipt numbers are.

Learn more about how vcita can help you streamline your payment flow.

From the first “hello” to the final invoice

Get paid 60% faster with a client billing software that supports your entire billing lifecycle:

When invoicing manually, it can be easy to accidentally forget to update the date, invoice number, or client contact. With automatic invoicing all data entry is done for you, reducing the amount of human error possible.

Vcita’s billing software sends automatic reminders to your clients when they have outstanding bills due, so your receivables don’t pile up. You can easily track from your payment dashboard exactly which invoices have been paid and which are due.

If you have employees who invoice, consider automated billing software for your own peace of mind. Automated invoicing means that you have access to any invoices your employees create, reducing the risk of employees making fraudulent invoices.

Receipt and invoice numbers are one of those things that never seem important until you need to use them. Vcita billing software automatically generates receipt numbers, which will ensure that your numbering system is consistent. It will give each receipt a unique number, in chronological order, which can become very important when you need to dig though your records.

1. What to Include in a receipt? (What to include may vary depending on how you do business).

2. What is the most common receipt type?

3. What is a delivery receipt?

4. What is a collections receipt?

5. What is a billing statement?

6. What is an official receipt?

7. What is a purchase order receipt?

8. What is gift receipts?

Goes hand in hand with your accounting software

Not sure? Schedule a demo