Even though technology has made it easy to accept credit card payments, a lot of small business owners get overwhelmed by the sheer number of options out there.

If you find yourself in such a position, we can’t blame you. There is a seemingly endless line of payment processors offering different fees, rates, and features – some of which are pretty hard to understand.

So, how can you know if you’re making the right choice regarding your payment processor? Is the option you’re looking at even beneficial for smaller businesses, and are you aware of what you’re paying for – and if you really need it?

Get ready – we break down the why and how below!

Why accept credit card payments

One of the major benefits of accepting credit cards is improved cash flow.

Since credit card transactions are verified electronically, you’ll get access to your money usually on the next business day. In addition, you’ll never have to wait for the checks to clear.

That’s not where the benefits stop, though.

By accepting electronic payments, your business will appear a lot more legitimate. Seeing credit card logos on the check-out window will do wonders for increasing the trust of your customers.

All of your customers will appreciate the fact that interacting with your business is more convenient, especially since electronic payments are one of the most common payment methods.

They’ll also help boost your bottom line and level the playing field with your competition. By introducing new payment methods, you will broaden the appeal of your business and your customer base.

Different ways of accepting credit card payments

There are three main types of credit card transactions that require specific technology and have a varied set of fees:

1. In-person

Accepting cards in person is useful for brick-and-mortar retailers or service providers. To accommodate these types of transactions, you’ll need a dedicated point-of-sale (POS) system with a credit card reader.

Since the customer is present when you insert the card into the reader, it’s categorized as a swiped transaction. These types of transactions usually have lower fees because they carry significantly less risk for fraud and lower chances of human error than card-not-present transactions.

2. Online

Businesses such as digital service providers, and e-commerce stores depend on payment service providers such as PayPal or vcita.

Since most modern website builders have online purchases in mind, they easily integrate with payment processors. This makes it easy to set up an online storefront.

If your website has trouble integrating with payment service providers, you can also link out to your account so your customers can pay through a third-party site. However, this should be your last resort because it’s a lot less streamlined and requires additional efforts to keep track of orders.

Due to the higher fraud risk, online payments typically have higher processing fees than swiped transactions.

3. Over the phone

For certain businesses such as restaurants that want the option of takeout orders, offering over-the-phone transactions might be a good idea. Similar to in-person payments, you’ll need to acquire a POS system to meet the hardware requirements.

Typically, over-the-phone payments involve a customer sharing their credit card information with the seller. The seller then manually has to enter this data into the card reader.

This falls into the keyed-in or card-not-present transactions. Hence, over-the-phone payments have the highest fees due to a greater risk of fraud. Additionally, there is even a bigger chance of human error, because the data is provided or keyed in manually.

How much does it cost to accept credit card payments?

The thing that confuses business owners most is the fees. However, they aren’t that hard to grasp. Every time a customer swipes their card or enters their credit card number online, you’re paying:

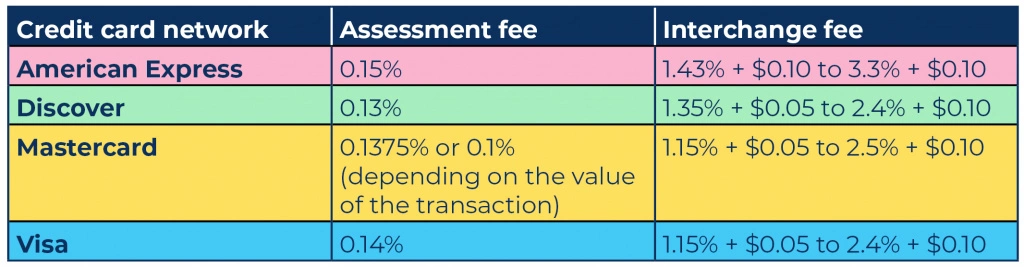

- Interchange fee that goes to the issuing bank;

- Assessment fee that goes to the credit card association and is set by each network every year;

- The markup fee that goes directly to the processor (more on that later).

You can get a better idea of the credit card company fees in the table below:

Which payment processors should small businesses use?

While there are a lot of payment processors out there, these five provide the most benefits for small businesses:

1. PayPal

While you might think it’s only good for one-off P2P transactions, PayPal is actually a great online payment processor in its own right.

There are a couple of reasons why it’s a popular choice for small businesses, with simplicity arguably being the main one.

It’s easy to set up and so fast that you’ll be able to accept payments tomorrow. PayPal also works well with most websites, so if you have no programming experience, this is a great option for creating a digital storefront.

The fact that it allows you to design your own custom shopping cart is a great bonus.

The processing fee is $0.49 per transaction plus 2.99% for most debit/credit card transactions.

2. Square

An amazing option for small physical and online stores is Square.

What makes it great for small businesses is the plethora of options that you get for free. With Square’s free plan, you not only get processing, but you also get a free website with SEO tools.

The free version also lets you sell your products on Facebook and Instagram.

The processing fee for swiped transactions is 2.6% + $0.10 per transaction. Naturally, online transactions will cost more – 2.9% + $0.30 with the free plan.

With Square Premium, which costs $72 per month, you’ll get a lower rate of 2.6% + $0.30.

3. Stripe

Stripe is another processor on this list that is fairly easy to set up and use. Just like Square, it has some extra features useful for small businesses. It’s great if you want to design a web store or enable in-app purchases because of tools such as:

- Stripe Sigma (SQL analytics tool)

- Radar for fraud teams

- Stripe billing

Even bigger businesses can benefit from Stripe due to discounts and the option of custom plans for businesses that process more than $100k a month.

Stripe is particularly appealing for smaller businesses as there are no monthly fees or minimums. The processing fee is 2.7% + $0.05 for in-person payments while using a dedicated Stripe terminal. The rate for online transactions is the same as Square’s: 2.9% + $0.30.

4. vcita

vcita is not just a payment processor – it’s also a full-fledged cloud-based customer relationship management solution for small businesses.

This means that you can manage all payments from a single interface and accept payments through numerous integrations (Square, Stripe, PayPal, Venmo, etc.), as well as phone, email, and offline payments into your business.

Even better, this processor also supports fast invoice payment processing for most types of credit cards, wire transfers, and cash.

There are no processing fees, so you’ll only be paying the minimal price for assessment and interchange fees per transaction. Payment processing is available in vcita’s Essentials plan that costs only $19 a month.

5. Shopify

Shopify is a full-scale solution that not only lets you process payments but also hosts your site too. This allows you to offer your customers a seamless experience without too much hassle.

While Shopify is renowned as an e-commerce platform, it can also be used by service providers due to its third-party app support. For example, there are many booking apps you can integrate into your site.

Another significant benefit is that Shopify lets you easily sell your products on other platforms, such as Amazon, Facebook, or eBay.

It also supports brick-and-mortar stores with their own card readers and POS systems.

If you go with Shopify’s cheaper plans like Basic Shopify ($29 monthly fee), the processing fees will run you 2.7% for in-person transactions and 2.9% + $0.30 per online transaction.

As easy as it gets

That wasn’t scary, right?

Any way you slice it, you’ll be doing a good thing for your business with long-term impact.

Keep in mind that while all the payment processors we listed are great for small(er) businesses, you still need to consider a couple of things.

For instance, what works better for you – no monthly fee with a higher transaction rate or a small monthly subscription without no markup fees? Do you need extra features like analytics tools or is only processing payments enough?

Once you settle on a processor you like that fits your needs, you can set up and start taking credit cards soon. Speaking from experience – your customers will appreciate it.